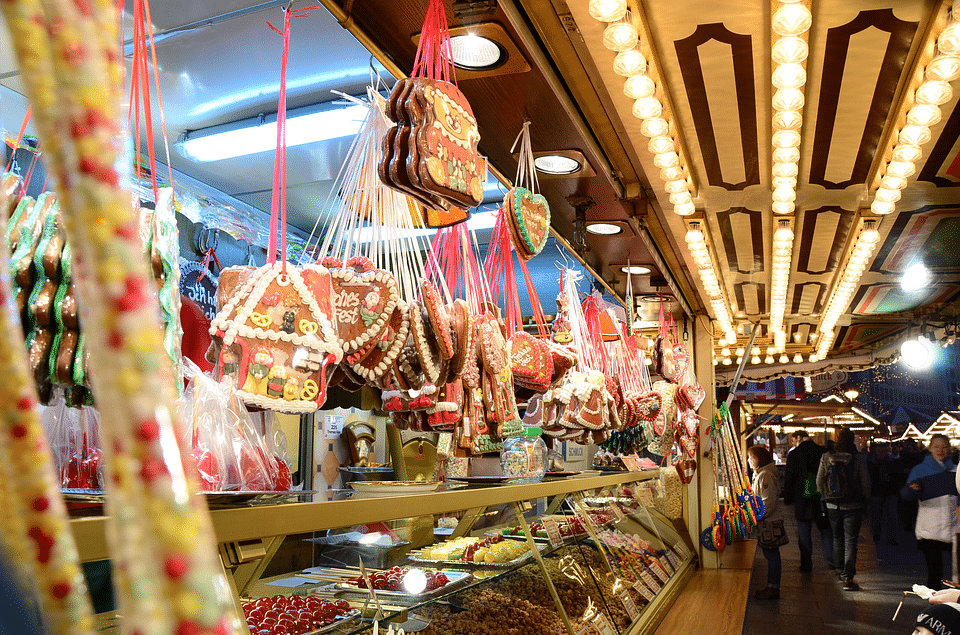

One of the reasons people dread the holidays each year has nothing to do with the season itself but, rather, the stress of shopping for gifts.

The holidays can rush up on you unexpectedly. One day its Halloween and the next thing you know it’s Black Friday. Blink again and it’s Christmas Eve. If the holidays catch you unprepared, a fun and joyous time of year can become a nightmare. A lot of things can go wrong in the run-up to the winter holidays, but many of those problems could be avoided with a holiday budget. This might sound like adding even more stress onto a stressful time, but it’s the opposite. That’s why we’ve put together this holiday budgeting guide which you can use as a road map to a happy holiday.

Credit: Paulina Sahz, Pixabay

Why Do I Need a Holiday Budgeting Guide?

There are obvious benefits to consulting a holiday budgeting guide like this, specifically that you can organize your gift-spending. It might seem like this would be as simple as making a list, but it’s a little more complicated than that. However, our holiday budgeting guide isn’t just about saving money. The very act of developing and implementing a holiday budget forces you to plan for them. You might just start your holiday preparations when it occurs to you or the last of the Thanksgiving leftovers are gone. With a solid holiday budget plan, you could be ready for Christmas before Valentine’s Day. Just like a household budget helps people organize their lives along with their finances, our holiday budgeting guide explains how you can do that with Christmas, Hanukah, and New Year’s.

What Do I Need to Start a Holiday Budgeting Guide?

Credit: D1v1d, Flickr

While it’s not totally necessary, before you start a holiday budget, you should have a household budget. Simply put, you should be aware of how much money comes in every month, how much you spend, and how much you save. The tips in this holiday budgeting guide might not work as well if you accidentally put more into it than you do your monthly expenses. You don’t have to get too detailed with it, just a general idea of your income and expenses are all you really need. This is just so you know what amounts you have to set aside in order to build up the gift fund.

There are other things you will need, but these will also be things you likely already have. You will need a deposit account with a bank or perhaps a service like PayPal. You will also need some system to organize your finances. You can stick with an old-fashioned paper and pencil, if you’d like. However, financial planning software like Quicken or others make this part of the job as easy as updating your status on Facebook. Finally, you will need to have some idea of what sort of gifts you will be getting and for whom. Once you have all this, you are ready to get started.

Why Use a Zero-Based Holiday Budgeting Guide?

Petr Katochvil, Public Domain Pictures

For our holiday budgeting guide, we’re using a zero-based budget. What this means is that, for the purposes of your holiday budget, every penny that goes into your savings is accounted for as outgoing. Honestly, this is the most common form of budgeting out there, and the style you are most likely familiar with. In fact, some people use the opposite of zero-based budgeting as a kind of savings plan. They round-up when budgeting expenses and round-down when budgeting income. The “hidden” money can really add up, especially if you don’t check your actual balances. Yet, this is not a good way to budget anything.

There is a discipline that comes with following a budget. So, instead of just letting a couple dollars here and there build up in your account, factor in your savings. Doing this will help you create a workable holiday budget. With a zero-based budget, you will know precisely how much money you have coming in, going out, and how much you save. It makes even more sense for the holiday budget, because the entire purpose is to spend that money on your family and friends.

Create a Holiday Budgeting Guide That Works with Your Lifestyle

With a working idea of your overall financial picture, you are ready to start a holiday fund. If you are single, don’t decorate or host, and have no kids, your budget might not be that complex. However, if you have a large extended family, host holiday events, and do a lot of cooking, the holiday budget will be more extensive. No matter how you celebrate, this holiday budgeting guide can help you be prepared for it.

1. Create a Separate Account

Credit: Rachmaninoff, Wikimedia Commons

The first thing you will need when creating a holiday budget is a separate account for it. Since the only time you will be using this money is in the run-up to the holiday season, go for a savings or, at least, a checking with interest account. You won’t get much of a return on the money, but in this case, something is better than nothing. Still, you want to make sure that you can get to the money when you want it. Of course, that could be as easy as transferring it from one account to another, something that can happen instantaneously if your main account is at the same institution as the holiday fund. If you use a third-party service, like PayPal, it can take a few business days, but PayPal also offers a free debit-card and are accepted at more and more point-of-sale terminals these days.

2. Create a ‘Shopping List’

Before you can figure out what your saving and, eventually, spending, you have to know where that money is going to go. It might seem a little presumptuous to make the list before you even have the budget in place, but it’s necessary information to create an accurate spending plan. Look to your past holiday celebrations for your inspiration. You’ll include your family, friends you buy gifts for, and even any office or church charity gift drives. You don’t have to know what you are getting or how much it’s going to cost (yet). This list is just to create a framework for determining your budget and how the money you save will eventually be spent.

3. Set Your Maximum Desired Spending Amount

A vital step in setting up your holiday budget is to figure out your maximum desired spending amount. Usually, other factors like your household bills or other expenses will make this determination for you. Still, this number will serve as the foundation for your holiday budget plan going forward. This is the amount you’re trying to reach as you save each month, and it will also help you determine how much to spend on each person. How you determine this amount is up to you, but you have to be practical. You can’t have a 50-item shopping list and a maximum spending amount. Well, you could, but people wouldn’t be very happy with their gifts. Unless they love cheap headphones or scratch-off lottery tickets, that is.

4. Factor In Your Holiday Expenses

Credit: Pixabay, Pexels

Creating a holiday budget is more than just a list of names with a dollar amount next to them. There are plenty of other holiday expenses to consider. If you travel over the holidays, make sure to factor the cost of that into your budget. House decorations, the tree, and dinners and party food should all be a part of this. It can be costly to host holiday parties or the big family gathering. Factoring all this into your budge ensures that not only won’t you be caught off-guard by the cost, the party itself will be amazing.

5. Treat Deposits Like Another Bill

As with any sort of savings plan, you will have to make regular deposits. Doing this is important to ensure you have the money you need when it comes time to start preparing for the season. This is the step that will require the most consistent discipline. In spring or summer, it might seem appealing to hold back your monthly deposit for extra spending money on your summer cruise or vacation. However, do this enough, and you will fall short of your ultimate goal. You have to treat this savings plan like you would any other expense.

6. Choose Your Gifts Early

Credit: COD Newsroom, Flickr

Eventually, you will have to decide what specific gifts you are going to get. Once you have a specific idea of the items you’ll be buying, you can set more precise spending limits. This will give you a clearer picture of how close to your maximum amount you’ll get. The earlier you do this the better. Not only because it gives you time to save money, it also gives you time to find the items. Let’s say you want to get the fashion aficionado in your life something she’ll love. It may take some looking (and even more time to ship) to get the perfect present in your hands. Even if you wait until the height of the season to shop, it will be much less stressful. You’ll know what to get, and where to get it.

7. Take Advantage of Sales

Credit: Reblbug, Pixabay

The main reason to choose your gifts early is so you can take advantage of sales. There are many times through the year that retailers offer discounts. For example, there is no reason to celebrate Amazon’s self-created Prime Day holiday just because. However, you can peruse those sales and perhaps snag some early deals on holiday gifts. This is great because even though you set a maximum spending goal, you don’t have to hit it. If you are able to get all the items on your list and have a few hundred or few thousand dollars left over, all the better. No matter what, you should be ready for Black Friday and Cyber Monday. These sales are made for people who aren’t caught off-guard by the holidays and wait to the last minute to shop.

8. Cut Expenses Where You Can

While it would be nice to find so many deals you end up with extra money, it’s just as likely things may be more expensive than you first thought. (Though, as you do this more and more, you’ll get much better at estimating the total cost of the holidays.) If you find yourself a little short, find ways to cut costs. For example, buy your Christmas wrapping supplies after the holiday season. Stores drop prices on paper, bows, bags, and the rest by as much as 80 percent to make space for their spring inventory. The same is true for decorations and other holiday kitsch.

Big, natural, expensive real trees might be your holiday tradition. However, at least at first, consider an artificial, pre-lit tree. Instead of an annual expense, you will use it over and over again. Today’s models often come with pre-installed LED or fiber-optic lights. Not only are these beautiful to look at, they save you hours and hours of time. There are plenty of ways you can cut costs during the holidays. Yet, if you stick to the advice in the holiday budgeting guide, this should almost never be a problem.

9. Avoid Cash Transactions When Possible

Credit: Pathfinders779, Wikimedia Commons

Some experts suggest, when shopping on a budget, sticking to cash-only transaction. The logic behind this is that once the cash is gone, the shopping stops. While this is true, having a separate account for your holiday fund serves the same purpose.

The reason to avoid cash transactions is that it’s far less precise than using checks or cards. The total is never an even-dollar amount, so you end up getting back change. This goes in your purse or pocket, not to be found until weeks later. When you get a couple bucks back here and there, you think nothing of spending it on a soft pretzel or fancy coffee. Using a check or card means that you have an accounting of where every penny went.

The other major problem with keeping your Christmas fund in cash is the obvious one. If you lose your cash or, heaven forfend, are robbed, your whole holiday budget goes up in smoke like so many Yule Logs. Rather than risk this or frittering your holiday fund away, stick to easily trackable transactions. It’s safer and more convenient, because you can’t use cash for online purchases.

10. Plan for Surprises

This final tip might seem like an oxymoron, but we assure you it’s not. The very nature of surprises is that they are unexpected, so it might seem impossible to plan for the. While there’s no sure-fire system for covering all emergency costs, you can give yourself a cushion. Any good household budget has an “emergency fund” for unexpected expenses. We recommend the same idea for your holiday spending budget. The holiday emergency could be anything. Perhaps an unexpected relative shows up for Christmas dinner or maybe your mother’s new dog trashed the tree. Something like this could make the holidays awkward or, even worse, ruin them entirely. If you have a few hundred dollars stashed in the Christmas fund, it’ll just be a matter of running to the store to get what you need at the last-minute.

A holiday budgeting guide is a great way to reduce the stress of holiday shopping and can help you avoid the crowds.

As the old saying goes: failing to plan is planning to fail. Our holiday budgeting guide is meant to help you during a busy time. There is no downside to planning for the holidays early. If anything, this will allow you to better manage your money throughout the year. When the holidays do come around, you will be able to get the finest gifts and the coolest Christmas decorations. Instead of being a frantic time running in-between the store and doing chores at home, you’ll eagerly welcome the start of the season. Instead of a looming responsibility, the holidays will be a time to put your well-honed plan into action.

What do you think? Are there any surefire tips you know of that we didn’t include in our holiday budgeting guide? Share your thoughts, reactions, and experiences in the comments below. Share the article on social media if you liked it, so your friends can get in on the conversation.

Related Article: How to Survive the Holidays Without Unnecessary Stress or Expense