Wouldn’t it be great to conveniently keep track on your earnings?

Money management isn’t easy, and even if you have a lot to spare, it can be difficult keeping your spending on track. Thankfully, there is handy software which takes the hassle out of planning your savings based on incomings vs. outgoings. Let’s take a look at the best budgeting software. Each of these have a different purpose which can either help you to make money, save, or simply analyse how much you spend.

Image | Product | Prices |

|---|---|---|

| ||

| ||

| ||

| ||

| ||

|

Things To Consider Before Buying The Best Budgeting Software

Let's take a look at the different categories you need to consider before looking at the best budgeting software. After all, based on your income, goals, and technological capabilities, you'll want to ensure you find the best budgeting software for your specific needs.

Credit: Flickr, Pictures of Money

What Do You Need the Best Budgeting Software For?

The best budgeting software makes your life easier, whether you use it for business or personal use. Budgeting is a huge part of all of our lives, whether we address it or not. Subconsciously, we’re always considering our income compared to expenses to plan for expenditures. The best budgeting software takes the guess work out of managing your money so that you always know your figures.

How Advanced of a Software Can You Handle?

Thanks to the evolution of technology, we no longer need to collect monthly statements, utility bills, or rent receipts to analyse our spending. Instead, budgeting software enables you to input your data. From there, they’ll accurately and carefully address how much you have to spend based off of your incomings and outgoings.

There are different types of software depending on how advanced your goals and needs. Many collect data by syncing to your credit card and bank accounts. Each time money leaves your account(s), the software records this to keep you on track. As such, you don’t even need to do much, rather than read the notifications of how you’re doing.

How Much Assistance Do You Need?

It’s worth considering how much assistance you need when purchasing the best budgeting software. Are you clueless at managing your money? Or do you just require some assistance with keeping records for your business? Depending on your personal circumstance and preference, it can affect how advanced you need the software to be.

Top 6 Best Budgeting Software for Money Management

We scoured the Internet to find the best budgeting software. No matter your reason for purchasing one, we've provided a variety of options. Each of these provides several components that will keep you on track no matter your goals.

1. Sage Software -- Sage 50 Premium Accounting

Sage 50 is a top and best budgeting software which enables up to five users to make the most of it. Store all of your money data in one secure location with module-level security. Sage 50 enables you to create and generate custom sale orders, invoices, quotes, purchase orders, work orders, and more. We really like these additional features which go beyond your basic budgeting software. Consequently, you can use these add-ons on a daily basis to help manage your workload as well as finances.

In addition, there are more than 125 customizable reports, so you can find the best option for your lifestyle. Depending on if you’re looking for basic features or expert analysis, you can work to your own standards and goals. Create reports on finances, inventory, sales, expenses, costs, personal and business jobs, and more. As a result, it’s one of the best budgeting software for people who have multiple types of finances leaving their accounts often. You can even setup job phases and cost codes to manage every step of the process. By doing this, you get a much more personal touch, allowing you to focus on things which really matter in your life.

PROS:

CONS:

2. Quicken Premier – Finance and Budgeting Software

Quicken allows you to see everything in one place, and makes manging and budgeting your finances seem easy. Connect to over 14,000 financial institutions to educate yourself and grab tricks on managing your money. The ability to print off bank or credit card transactions and balances whenever you require them is a cool feature for business owners.

At any time, you can log in and see where your money goes, without having to spend time navigating through the software. You don’t just see balances, but transactions which are organised into categorizes. You can customise these options, although the software can automate this for you based off of the different categories and topics.

Track and pay your bills from one location, so you don’t need to switch between different software to pay money. You can even use your existing bank's bill pay or use Quicken to quickly pay people directly. Connect all of your personal and business investments in one place to manage and analyse the data. Once you’ve connected all of your brokerages, you can view your portfolio, allocation, and performance whenever you require it. This helps you to better understand your fund holdings with regular reports.

PROS:

CONS:

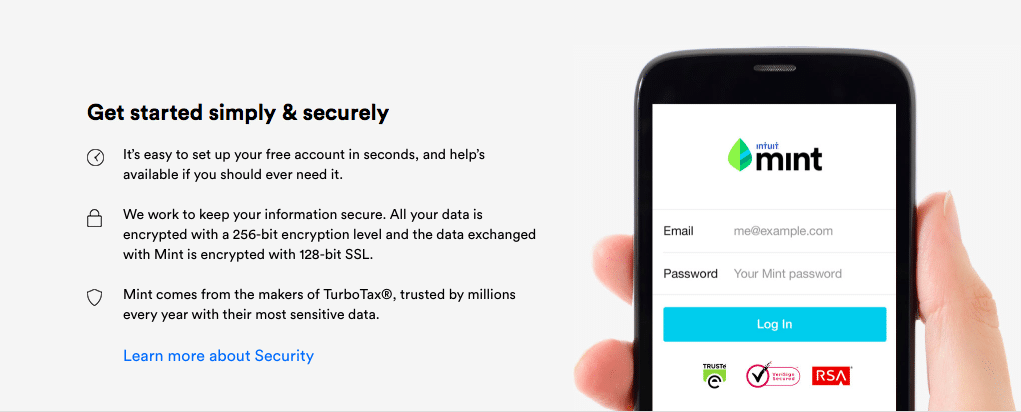

3. Mint

Mint is easy to set up in a few seconds, and there’s even a free trial to make the most of this best budgeting software. We love that it’s suitable for people who aren’t tech savvy or don’t have much time. Mint works extremely hard to keep your information secure and all your data is encrypted with a 256-bit encryption level. This gives you great peace of mind to know that they’re responsibly looking after your sensitive data. Trusted by millions of people every year, it’s one of the best budgeting software to use for any reason.

We really like that it simplifies money management and sticks to the core of what the best budgeting software is all about. For example, you can create budgets you’ll realistically stick to. Mint can also regularly advise you on how you can increase or decrease this, based off of your outgoings.

At any time, you can keep track of how you’re spending your money. Sync your account to multiple devices such as your phone, desktop, and tablet to manage your money on the go wherever you are. This is suitable for people who are busy or like to use different devices. The software isn’t too overwhelming, so you can take it one step at a time. Receive personalized tips and advice on maximizing your money every day.

PROS:

CONS:

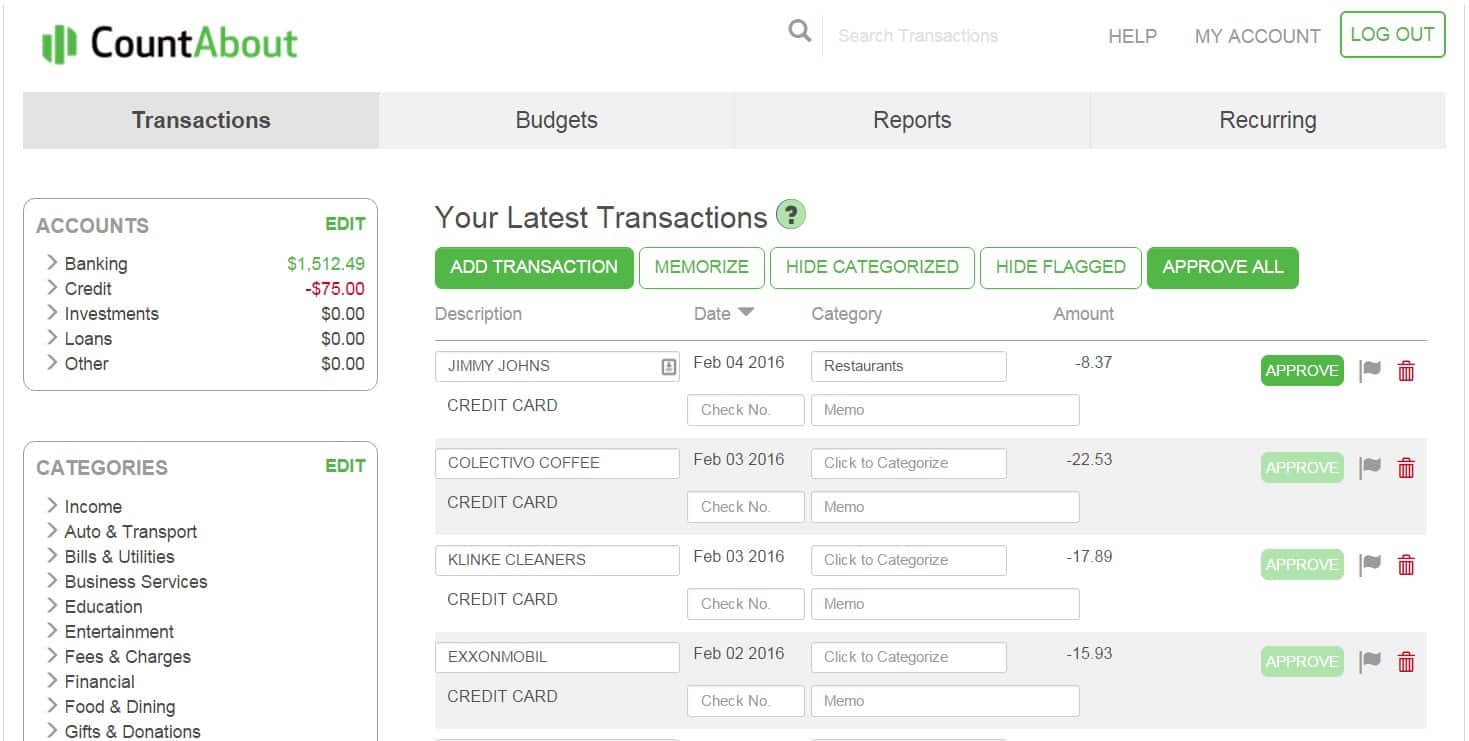

4. CountAbout

CountAbout is an easy-to-use personal budgeting software for anyone who wants to realistically track their income and outgoings. We like that there are a variety of features to download depending on your preferences. You can keep it as basic as you’d like, or expand to more advanced options as you continue your money-management journey. If you already have a budgeting software but would like to switch to this, they make the transition possible. You can seamlessly import data and use alongside over software, or solely switch to this.

There are many key features to CountAbout. With thousands of financial institutions on hand, you’ll never feel alone if you need additional support. For those who are concerned about their safety with budgeting software, you’ll love the multi-factor login for extra protection. You can even sync it up with iOS and Android apps to manage your money on the go.

Reports for account balances are sent to you on a regular basis. This means you constantly know where your finances are up to, without regularly having to sign in and analyse. Of course, you can export these reports as and when you need them. It’s an ideal solution for a parent who wants to budget saving for their children’s future, or personal plans.

PROS:

CONS:

5. MoneyDance

MoneyDance is one of the best budgeting software loaded with plenty of features to help manage your money. The software handles multiple currencies and virtually any financial tasks you need, with ease. As a result, this is an ideal choice if you work with clients from all around the world and ordinarily have to convert different currencies.

Access budgeting and investment tracking, account management, bill payments and online banking easily. The software can automatically download transactions and send payments from hundreds of financial institutions. This is excellent if you’re often paying different organisations and people. At any point, you can categorize and clean up downloaded transactions to stay organized.

The graphs and reports generate visual reports to make it easier to see your income and expenses. You can set up any type of graph you desire to make it easier to understand. The core of MoneyDance is to make your life simpler. Simply move the cursor over different regions of the screen to access any points you wish. The pop-up balloons support you if you need technological assistance at any point too. In addition, the account register is useful to enter, edit, delete and add any transactions. This is a great feature to ensure correct amounts and transactions are leaving your bank. If something out of the ordinary leaves your account, MoneyDance notifies you to verify.

PROS:

CONS:

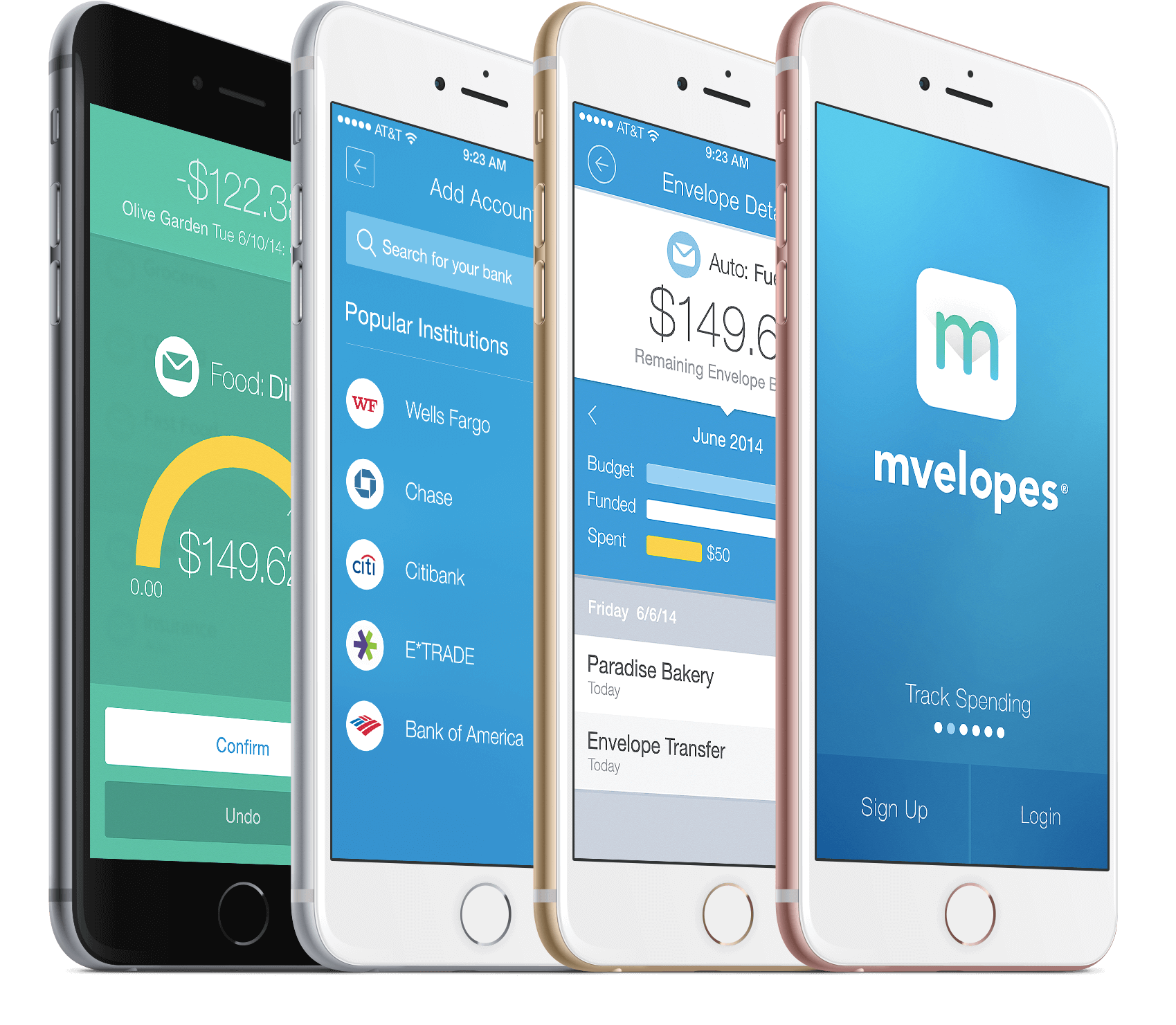

6. Mvelopes

Can you honestly say you know how much money leaves your bank and the date? If you can’t, Myvelopes might be the solution you’ve been looking for all your life. Once you sign up, you receive a Personal Finance Trainer who has the solution for all of your problems. By having a person to connect and talk with, you don’t feel alone in times of need. Their many years’ experience gives you confidence and support to change your budgeting habits too.

Mvelopes is another of the best budgeting software for many reasons. Unlike others, they don’t just track your expenditure, but help you to fix it too. This is a great option for anyone who requires assistance with managing their outgoings. The basic version helps you to design a debt reduction plan right from the beginning. This is tailored to your income and personal situation. As such, it’s a realistic plan you can stick to.

PROS:

CONS:

Helpful Products To Download This Software On:

Check out these other technology products to download the best budgeting software on:

Do You Use a Budgeting Software?

We hope you enjoyed reading about the best budgeting software available to everyone. This modern approach to budgeting and managing personal finances is a helpful guide to plan for your future. The simple interfaces of many of these enable you to assign money to other people regularly, or set up immediate obligations which need paying often. There are free trials on many of the above which enables you to try before you buy. Therefore, you can search for the right one for you before committing yourself.

Do you have a budgeting software preference? If so, let us know which one you use and why in the comments.

Related Article: How to Budget Your Income to Build the Biggest Nest Egg Possible