There are two large barriers to investing: capital and know-how. While we can’t help you with the first one, we certainly can help with the second.

The stock market is one of those things that people are aware of simply by paying a modicum of attention to society. However, to truly understand it is something that investors, economists, and journalists devote their lives to. Luckily, we’re only talking about stocks for beginners, and the barrier to entry is pretty low. There’s a lot to understand, and it might be confusing at first. But this list of tips about stocks for beginners should help you figure out just what you want to get out of investing.

In its simplest terms, the stock market is where you purchase small bits of companies in return for dividends. You can also sell your shares, hopefully for a higher price than you purchased them. How many people do that in a day, among other factors, determine the price-per-share you can receive. Of course, it’s all much more complicated than that. Keep reading to learn all you need to know about stocks for beginners.

Stocks for Beginners: Things to Know to Get Started

This guide covers stocks for beginners and what you need to know to make an informed decision about adding it to your portfolio. We can’t tell you what companies to invest in, nor can we predict when you should sell and when you should buy. In truth, no one can. However, people who follow stocks like your best friend follows sports or celebrity gossip can often make educated guesses about things like that. Find voices in that field you trust, but don’t just follow their lead. Learn what they do. This will help you ask the right questions.

1. What is the Stock Market?

Before you can worry about stocks for beginners, you have to know what stocks even are. Essentially, you are buying a percentage of a company when you buy a share of stock. This has been going on since as far back as the 13th century. The largest period of innovation, however, came out of the Netherlands in the 17th and 18th centuries, particularly with respect to colonization of the “New World.” Once that world got a little less new, it opened its own stock exchange on Wall Street in New York City. There are other markets, but the New York Stock Exchange has been around since the late 18th century and is the largest in the world.

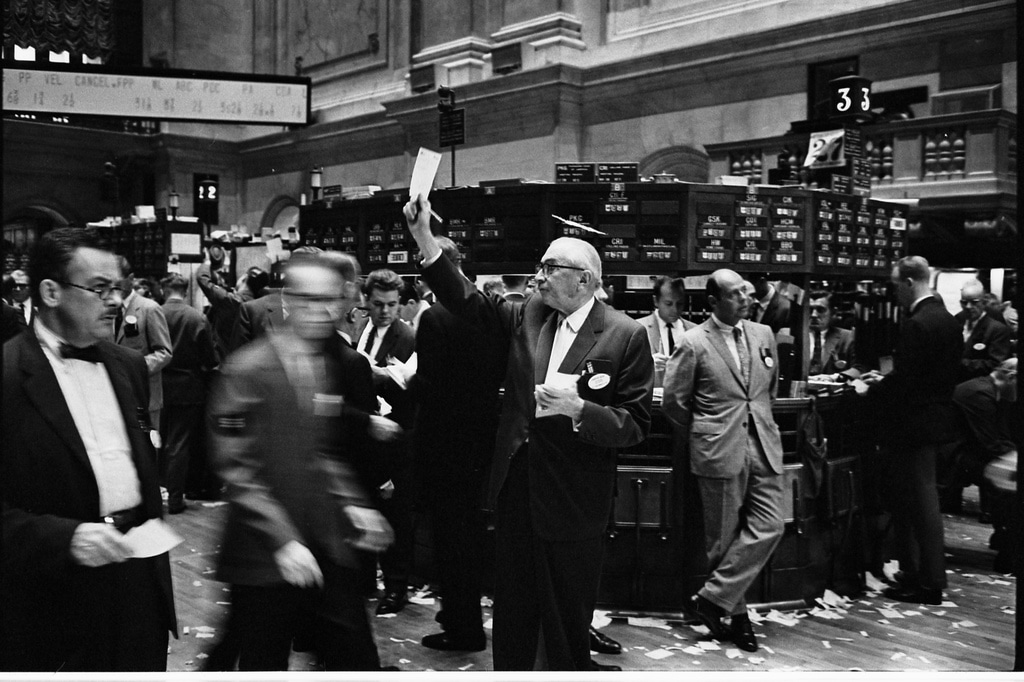

Stock exchanges are where investors list their stocks for sale. In many cases, companies list their stocks on as many exchanges as they can in order to both drive up the share price and attract international investment. Even though everything is done digitally now, stock exchanges still have traders on the floor buying and selling shares on behalf of their clients. The value of a stock market is not just monetary. It’s a way for businesses to raise capital and do so in the full view of the public. In fact, even though it’s a private institution, it is important to democratic capitalism because it ensures the “means of production” are in the hands of citizens and not the government.

2. Remember, Most of the Money Is Theoretical

The primary way to make money on the stock market is, obviously, through the buying and selling of stocks. The adage “buy low, sell high” applies here, as ideally you want to purchase stocks for a small amount and then sell them when the shares increase in price. You can also bet against a company through a process called “shorting.” This is stocks for beginners, so you don’t really have to worry about all this. Just know that beyond what you invest in the market, the money isn’t “real” until it’s in your hands.

For example, if you purchased Facebook stock a year ago, your portfolio took a serious hit last week. However most of the money you’d have “lost” only existed as potential value had you sold your shares before the latest price dip.

The best, long-term way to make money on your stock portfolio is to make long-term investments with companies that pay dividends. These are shares of corporate profits distributed evenly per share of stock. Sometimes, as companies grow, their stocks “split” effectively doubling what you have, allowing you to sell off shares as the price climbs back up. The only time you need to be concerned is if you start losing the money you paid into your account. But, luckily, there are companies who can help you with this, especially as it applies to stocks for beginners.

3. Find a Broker

Now that you are ready to dive into the market and stocks for beginners, you have to decide what brokerage firm is going to help you. What sort of firm you choose depends on what you want to do and how you want to invest. Are you interested in tracking the market yourself and day-trading? Then you should choose an online service like E-Trade, TD Ameritrade, or any of the dozen others you can choose from. The goal here is to make short-term gains by buying and selling as the price fluctuates throughout the day. If this is the route you want to go, you will need at least $30,000 in your account to start.

However, if you don’t want to make being your own stock broker a hobby, go with a firm that will handle your investments for you. This doesn’t mean handing over your savings to some Gordon Gekko-type and hoping for the best. No, a good broker will discuss your goals, your interests, and develop an investment strategy that fits your values. While your broker will offer advice on what to buy or sell and when, ultimately what you do is your decision. Stocks for beginners are much easier when you have an expert you trust in your corner.

4. Set a Budget

Now that you have a brokerage firm, the next part of stocks for beginners is to figure out how much you want to invest. As mentioned above, if day-trading is what you want to do, you will always need an account with at least $30,000 in it. If you’re willing to wait a bit longer to see capital gains, you can set your budget at whatever you want. You can treat your investing account like a savings, depositing money into it every month or every quarter. However, unlike a savings account, your balance will go up and down with the market. Patience is key.

To be clear, you can lose money playing the market, and we’re not just talking about fluctuations in the value of your stock shares. So, when setting your budget make sure that you start with an amount that won’t ruin you if it’s lost. This is, of course, a worst-case scenario but a risk that doesn’t come with more traditional forms of savings and investment. Though, worth noting as part of stocks for beginners, that every time the market crashes it does eventually rebound. It may take a decade or more, but if your timing is right and you’re patient you can rebound as well.

5. Decide Between a Personal Portfolio or Mutual Funds

If you’re not day-trading, as part of stocks for beginners, you will have to determine what you want your portfolio to look like. Usually, your broker will discuss what you want to get from investing, and then guide your strategy accordingly. The first major decision is between creating a personal portfolio or buying into mutual funds. With the latter, you won’t have much say in how your money is invested. Yet, it’s more stable and offers more predictable returns. Mutual funds often mean that should the market take a dive, you won’t lose your shirt.

If you want a bigger return on your money, a personal portfolio is likely the better choice than mutual funds. Working with your broker, you can invest in companies that pay regular dividends. Conversely, you could experiment more. You could invest in companies that you want to support, or think will be big. You can try to capitalize on bubbles or avoid them completely. It will take some homework, but you can develop a portfolio any way you want. Just remember that in the market high risk doesn’t always equal high reward, especially as it applies to stocks for beginners.

6. Diversify

If you put your money into bank products, it makes sense to keep most of it with one company. It increases your value to them as a depositor, and your wealth is secure. When it comes to stocks for beginners, you want them as varied as you can. Spreading your investments around into different companies and different sectors is a great way to ensure that one bad day on the market doesn’t affect your portfolio’s value in a negative way.

Look to your broker or business trends for ideas about new places to put your money. If it is a promising young company or an emerging market, it might be more of a risk. You’ll want to balance that with some stock in an established company or market. But with stocks for beginners, there has to be a strategy to it. If you just pour money into different options without doing your due diligence, it’s as bad as not diversifying at all.

7. Learn How to Read Stock Valuations

If you watch movies about hot-shot stock brokers trying to take over Wall Street, you likely have seen some version of a familiar story. In an effort to get rich, unscrupulous brokers scam their clients out of their own money by pulling a fast one on them. It’s not just fiction, either. Much of what happened with the 2008 Financial Crisis was because unscrupulous finance professionals sold off investments they knew were bad and then bet those bad investments would fail. So, even though you trust your broker, part of stocks for beginners is the ability to learn and understand what they are talking about.

Reading stock valuations helps you get a better picture of the state of the company you’re investing in. You can see how much cash they have on-hand, what their assets are, and other key details that let you judge its performance. If you can figure this stuff out for yourself, no broker in the world would ever try to cheat you. And if they tried, you could call them on it. It’s complicated and a lot of work, but worth it if you want to really get serious with your investments.

8. Pay Attention to Business News

Credit: Pink News, Flickr

Along with earnings reports and stock valuations in stocks for beginners, you will have to pay attention to the business news of the day. From the stock market ticker at the bottom of the screen to the interviews with business leaders and experts, all of it can help. For example, if you are heavily invested in a company whose CEO falls ill or is suddenly fired, you need to pay attention to what the next moves are. Companies inform their investors of these things, but business reporters are always looking to break the news first.

Of course, the business news media is another industry where hours and hours of time have to be filled with talking heads yammering at each other. They have agendas and roles to play just like in political news media, and there’s often overlap between the two. So, figure out which voices to trust and judge each guest and story on its own merits. For the most part, when it affects your portfolio, your broker knows about it before it’s in the press. Still, watching the headlines can keep you abreast of developments and possible new investment opportunities.

9. Think of the Market Like Blackjack

Credit: Eva K

Now, you are familiar with the market, know how to evaluate companies, and are caught-up on the business news of the day. You have a broker that you trust, but one who will do whatever you tell them to do. You’re ready to really “play the game,” even as it applies to stocks for beginners. Despite its importance to the worlds’ economies and the future of businesses, the stock market is just a high-stakes casino game. So, it’s not inappropriate to think of it that way sometimes. You have to play the game to win, but if you throw good money after bad decisions you end up busted or in hock to the house.

Unlike roulette or blackjack, however, the stock market doesn’t just rely on luck. You can use all of the information we’ve discussed previously to make informed decisions about your moves. Let’s say there is a company in trouble, but you like the CEO and think she’s going to turn things around. You do your research, but nothing’s certain. Sometimes you just have to roll the dice. Just remember, if you do take a chance it’s possible you can lose. So tread carefully, and never put all your chips in one pot - a wise tip that applies to other areas of life besides stocks for beginners.

10. Know When to Cut Your Losses

Credit: Wendybbook, Flickr

At the turn of the 21st Century, the big bubble on the market had to do with the internet. Called the “Dot-Com Boom,” it burst and in a week’s time companies that were thought to be worth hundreds of millions of dollars were busted. One company caught up in that crash was a plucky little bookseller making moves to expand further into the retail space. Nearly 20 years later, Amazon is one of the biggest companies in the world and its CEO is the richest man in modern history. But in 2000 or 2001? No one would have blamed you for dumping your Amazon.com stock.

Knowing when to cut your losses is tough. First, you have to avoid reacting with fear or panic. If you’re saving for your retirement and your portfolio dips three years in, you can afford to wait for the rebound. Second, you have to make sure that the rebound is possible. The year after the iPod hit the market was not the year to invest in CD Players. If the technology evolves beyond the company, it’s already too late to bail out. Still, with enough diversification, you won’t have to worry about losing your whole nest egg.

11. Unless You Love It, Leave It to the Experts

Playing the market is a great way to support good businesses, make extra money, and – if you’re lucky – can give you the freedom to do whatever you want to do.

Stocks for beginners can seem like a daunting and impenetrable world, but it’s one that’s easy to demystify. If you are willing to do some homework and find a broker you trust, you can dive into the market knowing that you are likely going to come out the better for it. It has its ups and its downs, but for the time being the trend continues to go up. And, barring catastrophe, it will probably continue to do so until we evolve into one of those science fiction societies that somehow doesn’t need money anymore. Of course, even if that happens, someone will probably start selling shares in laser guns and faster-than-light engines.

Hopefully, this list helped clear some of the fog from your eyes when it comes to stocks for beginners. It’s the first step on a long journey, but one that can could lead to financial independence. Whether you are saving for the future, helping to grow companies, or looking to live off your capital gains, the first steps are the hardest to take.

We hope you enjoyed this list and found it helpful. What do you think? Share your thoughts, experiences, or advice in the comments below. And don’t forget to share the article on social media so your friends can get in on the conversation.

Related Article: How To Manifest a Money Mindset That is Healthy & Productive