Money management isn’t easy, and it doesn’t come naturally to most of us with so much temptation in today’s society.

Luckily, we’ve found Mint: a revolutionary money-management software which makes finances less intimating and saving more possible. If you need help getting started with your bills or just a software that will keep you on track, Mint is the perfect solution. Let’s take a look at the idea behind this brand and its many fascinating features.

A Little About Mint

Mint is a web-based financial software service for the US and Canada, created by Aaron Patzer. It originally provided account aggregation through a deal but moved to connecting to account. Its primary service and goal enables users to track bank, credit card, investment and loan balances. This also includes loan balances and transactions through a single user interface.

Users can create budgets and set financial goals which is what this brand is most recognized for. For the past eight years, Mint announced that it connected with more than 16,000 US and Canadian institutions and supports more than 17 million individuals. During their launch, they claim to have helped over 20 million users – including individuals and organizations with little to full financial experience.

Who is Mint Great For?

Mint is designed with a variety of people in mind from all walks of life. Management of your personal finance isn’t easy and many of us have poor habits which we’re not even aware of. However, this money-management software makes talking money easy. Personal finance software isn’t always straight-forward, but Mint takes it right back to the basics so anyone can use it. You don’t need a degree to understand, and you can still operate this software with little technological skills.

This great software enables you to customize it to your life, goals and needs. As a result, managing your financial life will become easier over time. This product is great if you’re prone to paying late fees without even knowing about it. Mint will notify you via text that your monthly, quarterly or yearly bills are due to help you prepare and avoid fees. This financial software shows you exactly how disciplined spending helps you achieve your financial goals, like a vacation or paying off a loan. As a result, it’s easier to avoid giving in to those little temptations you might face every day.

What are the Best Uses for Mint?

As Mint is designed with money-management in mind, it’s great for personal use. The main feature of this personal finance software is to manage your spending patterns and fix your unhealthy money habits.

Perhaps you’re prone to spending money without even realizing it, and don’t have a set budget in mind. This is great to analyze your spending, but more importantly to improve how you approach and manage money. Filled with tips and advice, you’ll learn some useful strategies from it without feeling like you’re being judged.

As Mint is packed with advice and resources, you will learn something each time you sign into the count. Instead of searching the software to explore your habits, Mint will regularly inform you to keep you moving forwards and generating healthy money habits.

Helpful Features & Benefits of Mint

Mint is the best software for you, and one of the biggest benefits of it is that it’s free. With no financial risk involved, you can have peace of mind knowing that you’re improving your future. There’s no need to download any special software onto your computer, which makes it easier to manage with whatever technological device you use. Let’s take a lot of the top features of Mint and why it’s worth investing in.

1. It’s Simple and Free to Set Up

We love that Mint is simple and free to set up, which makes it at an excellent choice for people with little knowledge in technology. This software connects to almost every US financial institution connected to the Internet. In just a few minutes, you can see where your money is going, as well as get ideas on how to stretch it farther.

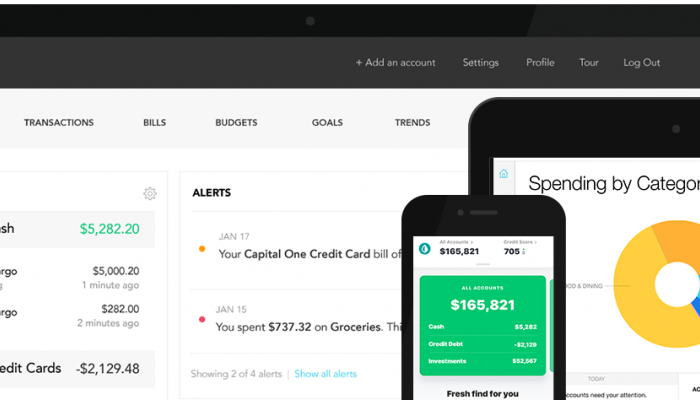

Mint automatically updates and categorizes your information, so you don’t really have to do much. From your bank accounts and credit accords to your savings account and retirement accounts, - it’ll calculate the numbers and data for you. Consequently, you can sit back and relax whilst having peace of mind knowing that it’s all getting sorted for you.

As you can watch and manage your money, Mint helps you to find savings along the way, without even feeling like you’re trying. They analyze thousands of offers on the Internet and make recommendations. Each find is analyzed and checked before being brought to your attention. As a result, you get a personalized experience which differs from other customers.

2. Alerts and Advice Whenever You Need it

Mint specializes in making your life easier so you can focus on other things in your life. They’ll inform you if there’s something you need to check to prevent you from manually checking yourself all the time. They’ll tell you if you’re receiving a charge, heading over your budget, something seems suspicious or anything else. Their main priority is to keep you safe and improve your way of managing your finances. Each week, they’ll send you a summary which shows how you’re doing. This is a great feature because it keeps you in the loop without excessively checking.

Mint’s main concern is to avoid fees and penalties heading your way. Receive alerts when your balances are low or bill payments are due. It’s like having a friend there to support you when you need it most in your life. See how much money you’re throwing away on fees and receive tips and advice on improving your money management. If it looks as though you’re about to exceed your budgets, you’ll receive a warning notification well in advance. Mint also send bill reminders to your cellphone or e-mail to help you pay on time. This means you’ll never have to worry about missed payments again, and you can get your life back on track.

3. Easy and Effective Ways to Budget

Mint aims to inspire you with easy and effective ways to budget through methods which aren’t intimidating or confusing. When you first sign up, they’ll calculate average spending by category so you can easily create a budget based on spending patterns and experience. See how much you’re spending on what, year-to-year or month-to-month. Depending on how you’d like to receive and read your information, Mint enables you to customize the app to your liking. This makes it a lot more productive and entertaining.

Perhaps you’re hoping to save but struggling to meet your savings goals. Mint can help you plan ahead and see how much you’ll save cutting back in any category. You can even plan for one-time-only expenses and recurring monthly expenses. They’ll show you exactly how much your spending decisions affect the money you have at the end of the month or year. You’ll also know what you can do today to save for tomorrow, without it seeming impossible. Mint wants to make your life easier and more productive. You can track all your bills on the go in Mint, and this includes credit cards to utilities and babysitter fees. It’s all in one place which makes it easier and more possible to manage your finances.

4. Investment Tracking

Not everyone likes the word investing, but it’s a huge part of your financial life. Mint help you stay on top of your investment decisions every day so that it seems possible again. Compare your portfolio to market benchmarks and instantly see your asset allocation across all your investment accounts. This includes: 401(k), mutual funds, brokerage accounts and even IRAs. With advice and tips every day, you’ll get the right tools for your investment style. Whether you’re hands off, active or somewhere in-between, Mint can help you do more with your portfolio.

Another important aspect of investing is not allowing fees to nibble at your earnings. So many people experience this because they don’t plan and research their finances thoroughly enough. They’ll help you identify the unnecessary fees and ensure that every cent possible stays where it belongs. It’s like having an expert at your fingertips, whilst understanding everything they’re saying your way. As Mint helps you to watch and manage your money, they’ll also support you finding savings and making wise investment choices along the way. They’ll regularly make recommendations and send you advice based on your lifestyle and goals, so there’s no need to worry. This is also a great way to advise you in the right direction if you have no prior experience or understanding.

What People Have to Say About Mint

Most people have positive feedback about Mint and we’re pleased to hear that it’s improved people’s lives. Easy to set up to use, it maintains your accounts on autopilot to you have more time to focus on other areas in your life. The pleasing design makes it easy to navigate around, and the bold colours are inviting. The majority of users love that it’s simple, yet effective to use. Mint keep it simple, although the options aren’t limited, but useful.

PROS:

CONS:

With graphs and charts, you receive factual information in an eye-opening way which isn’t exhausting. Throughout your time with Mint, they’ll keep you up to date on what money is coming in and out. As a result, it’s an excellent way to save without overthinking your every action.

Alternative Money-Management Software to Consider

We hope you enjoyed reading about the benefits and feature of Mint. However, if you’re looking for an alternative produce which has more features, we’ve found some excellent alternatives. All of these vary from Mint so that you have more/less options, depending on what your goals are.

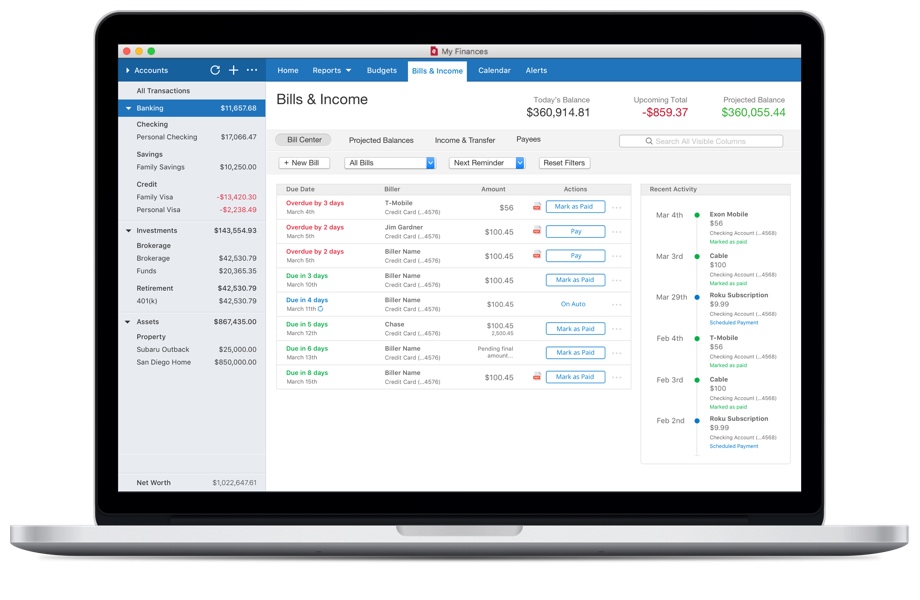

1. Quicken Premier

Credit: Quicken

Quicken Premier allows you to efficiently manage all of your personal financial accounts in one program. As a result, it provides you with a single source for managing cash flow, savings, mortgage, loan and credit accounts. There’s no need to write anything down or save receipts. Quicken Premier will safely import all your transactions. This is a feature which Mint doesn’t offer. As a result, it’s an excellent option if you require support in saving receipts for personal and business use. This software also helps you to stay on top of your spending. They categorize your transactions and put them all in one place. In just a matter of minutes, you can get started -- simply enter your bank account information and they’ll do the rest. This is a great alternative to Mint because it makes the setting-up process quicker and simpler.

Take the next step in your life with their powerful tools to help you get there. Create a realistic budget to pat off your debt, plan for retirement or save. They help you to get on a flexible budget which works for you. Simply see how your investments are performing against the market so you’re always aware of your behavior and which direction it’s heading in. This software is also a great alternative to Mint because it heavily focuses on safety and security. Your information is unreadable as it’s imported from your bank, so you don’t need to worry when setting up. They protect your financial information using robot 128-bit and 256-bit encryption. Consequently, you can get on with your life without worrying about your security. This is also a great option for small business use too, and you can easily separate your accounts when reviewing the data.

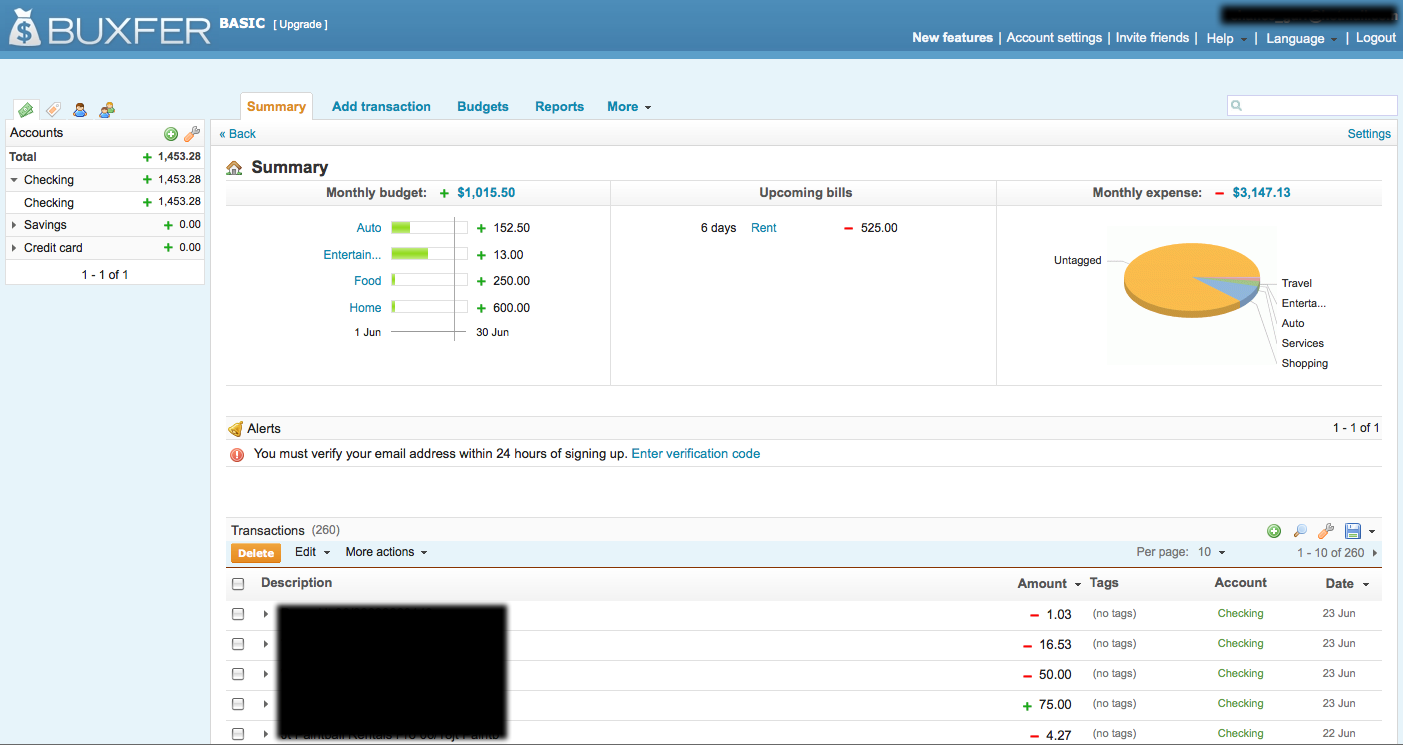

2. Buxfer

Buxfer is one of the best personal money-management tools and an excellent alternative to Mint. Their mission is to help people make better spending decisions. They believe there is no one-size-fits-all solution when it comes to management money. Good money management doesn’t just mean automatically generating charts. Instead, they adapt to your need and give you control and flexibility to customize it as needed. Buxfer delivers insightful, actionable advice to help you plan for the future if you have no inkling how to achieve that alone. Flexible, yet easy to use, they provide powerful analytics and deep insights into money habits. Also, they deliver real-time, actionable advice for changing your behavior to be more positive.

If you need a push to proactively plan and set goals for the future, then Buxfer is an excellent software for you. Their offline sync feature enables you to sync without needing to store your banking username/password on their service. With top-notch security, this includes high-grade encryption and regular audits by independent security firms. By supporting a variety of formats, such as Excel, MS Money and Quicken, this software supports statement formats. In addition, you can easily reconcile uploading transactions with manually-entered transactions.

The free-form tagging feature is an exceptional idea which enables you to attach multiple tags for the same transaction. By creating your own tagging structure, you become more in control of using this software and managing your finances. This works with any merchant anywhere in the world. You’ll receive better understanding of your spending with visual tools that let you slice and dice your expenses or income in any way you want. You can also spot unexpected spending patterns with visual tools.

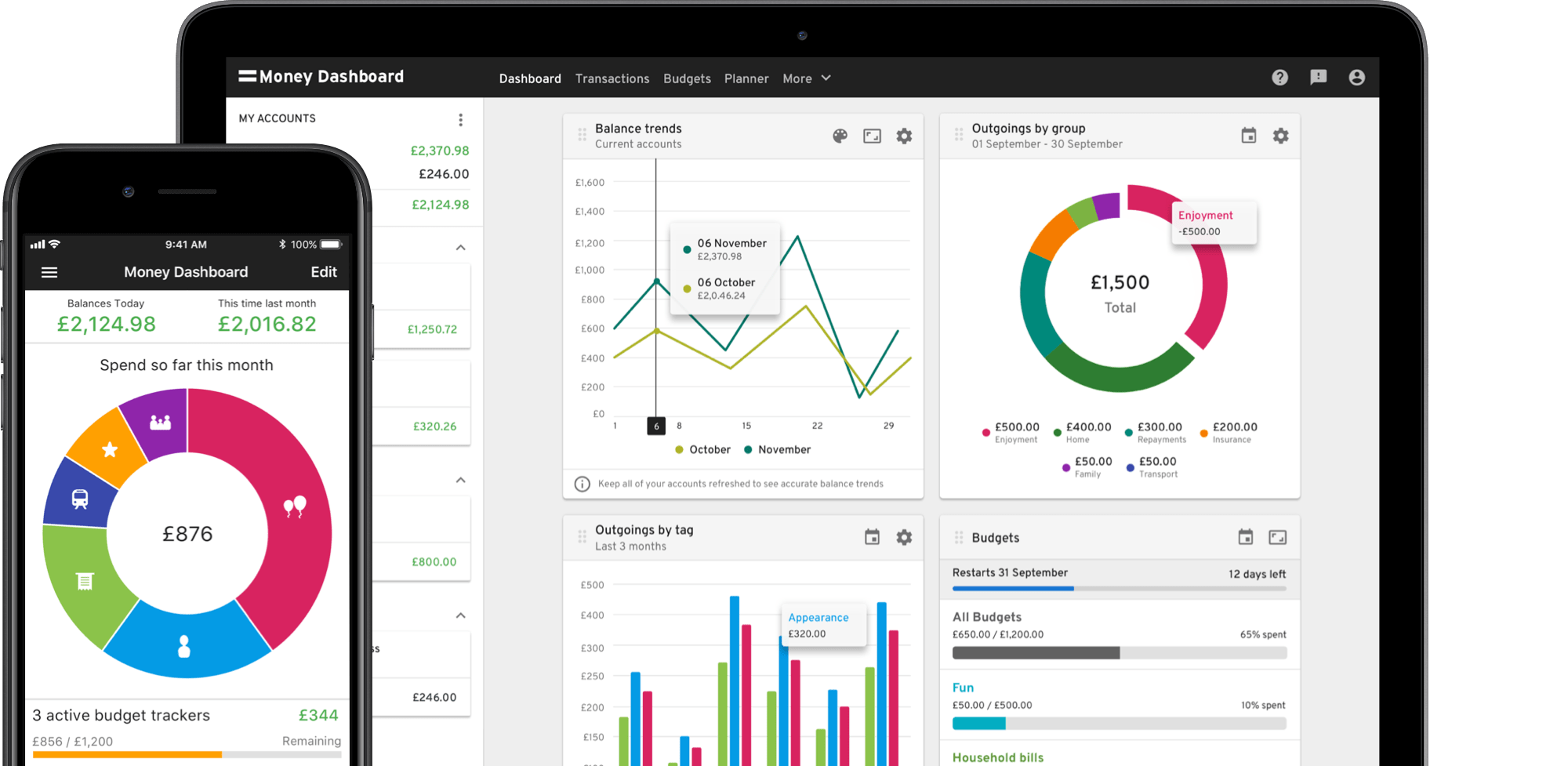

Money Dashboard is another excellent alternative to Mint. If you’re looking for a non-intimidating money-management software, then this is a great option for you. Save money, plan and achieve your goals with this free multi-award-winning money app and budget planner. Via their dashboard, you’ll have all the information you need to make informed financial decisions with a clear view of how, when and where you’re spending your money. They categorize everything automatically and display it back to you to give you the answers without any effort. You'll see the bigger picture of your financial life by showing you all of your accounts in one place, no matter who you bank with. There’s no more logging into multiple apps or working out complicated sums in your head. Get all of your thoughts and concerns out of your head and onto the paper.

Create your budget plan for all the areas of spending which matter to you. Achieve this in seconds. You decide the budget frequency and your target spending. They categorize everything automatically and display is back to you, so you have the answers at your fingertips. Take a look into your future without feeling intimidated or overwhelmed. Set yourself up for success by seeing your predicted income, expenditure and balances presented in front of you. You can instantly set predictions for money coming in and out of your accounts to see where your future is heading. This is a great feature which Mint doesn’t offer, because it enables you to see the direction you’re heading in, and make changes if you’re not happy about it.

Will You Invest in Mint?

There are many more features to Mint which we didn’t have time to mention above. This popular app focuses on the big picture of money management to help you make sensible and positive actions which will change your life. Budgeting using Mint is different to other finance software because it’s simple and effective to use.

After reading this article, are you enticed to invest in this software? We’d love to hear your thoughts and feedback, so keep this conversation going in the comments. If you enjoyed reading about its features, feel free to share this article to spread the word.

Related Article: Best Budgeting Software For Money Management & Savings Help